In 1996 when Steve Forbes was running for president he was pushing a plan for flat taxes as a way to “simplify” filing your tax returns. I remember thinking that only someone who has never done his own taxes could think that looking up the tax in the back of the booklet was the hard part. Not only was he proposing a flat tax, he wanted to eliminate all taxes on capital gains. Billionaire Steve Forbes would get a massive tax cut and shift the burden of taxation down to ordinary working people like me.

Now he is at it again, behind the scenes, using Texas Governor Rick Perry to push for a flat tax. Again it will give billionaires like him a massive tax cut while asking the rest of us to pick up the burden.

And Rick Perry isn’t the only candidate pushing this take from the poor and give to the rich philosophy. Herman Cain was first out of the block with an insane 9-9-9 plan. Newt Gingrich and Michele Bachmann, not wanting to be left behind, have both come out supporting flat tax plans.

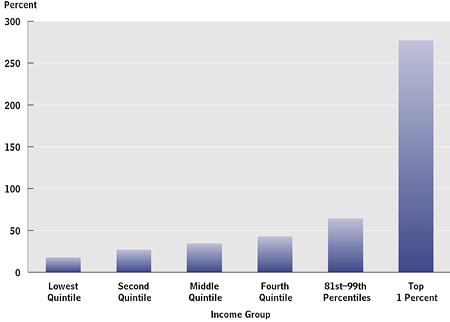

The Congressional Budget Office just published a report on the distribution of household income[1]. It shows a dramatic concentration of wealth at the very top. The top 1% of the population had an average income increase of 275% while the bottom 60% averaged less than 40%.

Growth in Real After-Tax Income from 1979 to 2007

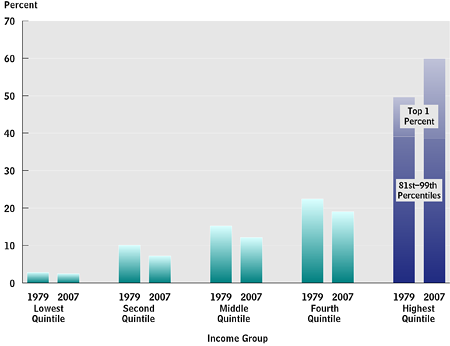

The top 1% had a dramatic increase in their share of the total income while every other group in the bottom 99% showed a decrease in their share.

Shares of Market Income, 1979 and 2007

For decades US tax policy has favored the very rich. But it’s not enough, they want more. I can understand that. What I have trouble understanding is how a political candidates can be successful pushing tax proposals to the disadvantage of 99% of voters. Do they think we are all stupid? We will have the answer come next November.

[1] Congressional Budget Office, Trends in the Distribution of Household Income Between 1979 and 2007, October 2011